XRP Price Prediction: $5 Target Possible by Q4 2025 Amid Regulatory Clarity

#XRP

- Technical Bottom Forming: Oversold RSI and Bollinger Band squeeze suggest impending volatility

- Regulatory Catalysts: SEC case resolution and ETF prospects may drive institutional interest

- Utility Expansion: Japan's real estate tokenization could significantly increase XRP's transaction volume

XRP Price Prediction

XRP Technical Analysis: Short-Term Bearish, But Bulls Lurking

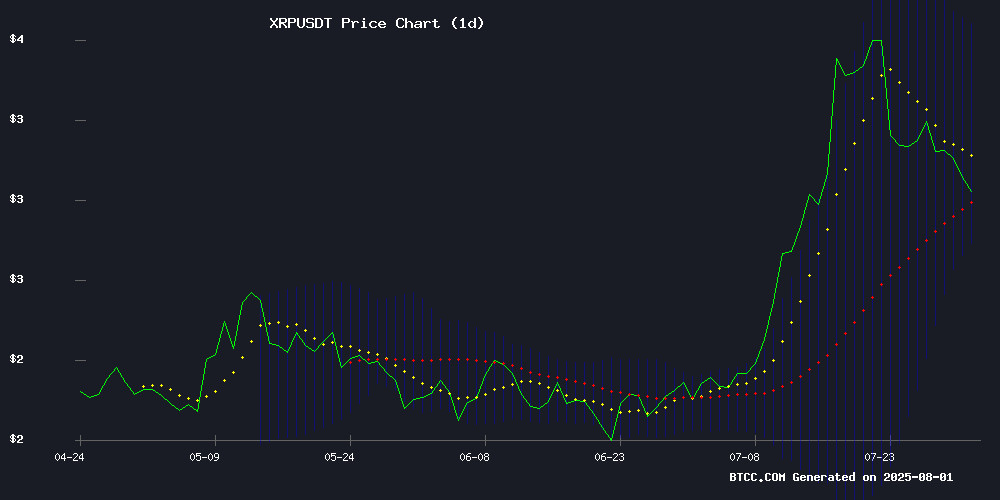

XRP is currently trading at, below its 20-day moving average of, indicating short-term bearish pressure. The MACD histogram shows a slight bullish divergence at, but remains in negative territory. Bollinger Bands suggest the price is NEAR the lower band (), which could act as support.says BTCC analyst Robert.

XRP Market Sentiment: Mixed Signals Amid Regulatory Progress

News headlines show conflicting sentiment: while whale selling and price volatility create short-term pressure (), fundamental developments like Japan's tokenized real estate plans and potential ETF approval provide long-term support.notes Robert.

Factors Influencing XRP’s Price

XRP Drops 8% Amid Market Volatility as Whales Offload Holdings

Ripple's XRP tumbled 8% to $2.91 in a sharp 24-hour decline, erasing gains from its recent rally. The sell-off accelerated during midnight trading on August 1, with hourly volume spiking to 259 million XRP - four times the average - as whales dumped $28 million worth of tokens.

Exchange balances had shown signs of depletion prior to the drop, suggesting accumulation by large holders. Technical analysts remain cautiously optimistic, noting XRP's monthly candle closed bullish despite the daily setback. Key levels to watch include resistance at $3.23 and critical support at $2.80.

The token's market capitalization now stands at $174 billion, with trading volume reaching $7.4 million. CRYPTOWZRD, a prominent analyst, suggests holding above $2.80 maintains bullish potential, with a break past $3.30 potentially triggering a run toward $3.65.

XRP Price Dips Amidst Rising Volume as Traders Reposition

Ripple's XRP fell 6.23% to $2.95, retreating from a $3.15 high as trading volume surged 13.96% to $7.53 billion. The divergence suggests active profit-taking or portfolio rebalancing ahead of the next market move.

Despite the daily drop, XRP maintains a 4.45% weekly gain, with its market capitalization holding at $175.1 billion. The token's movement contrasts with outperformers like Conflux and UNUS SED LEO, while laggards include SPX6900 and Curve DAO Token.

Market dynamics reflect the tension between short-term traders capitalizing on volatility and long-term holders betting on institutional adoption. Such volume spikes during price declines often precede directional breaks—either as continuation patterns or trend reversals.

XRP Price Rebound: Bulls Eye Recovery After Key Technical Bounce

XRP shows signs of stabilization following weeks of volatility, with its recent bounce off the 26-day exponential moving average suggesting potential for trend continuation. The cryptocurrency found footing near $3.00 after retreating from a local high around $3.70, with declining trading volume indicating diminished selling pressure.

This consolidation phase marks the first test of the 26-day EMA since XRP's mid-July rally, a critical juncture for confirming bullish reversal patterns. Resistance between $3.30-$3.40 now serves as the immediate hurdle for price recovery, while failure to maintain current support could see declines toward $2.60-$2.30 levels.

XRP To Become Backbone Of Tokenized Real Estate In Japan

Japan's financial landscape is undergoing a transformative shift as Mitsubishi UFJ Financial Group (MUFG), the country's largest bank, prepares to tokenize real estate on the XRP Ledger (XRPL). This strategic MOVE positions XRP at the forefront of Japan's blockchain-driven asset revolution, diverging from speculative market trends to focus on tangible infrastructure development.

MUFG's initiative leverages its existing partnership with RippleNet, building on prior cross-border payment collaborations. The bank now aims to extend this technology to institutional and retail real estate markets, signaling a transition from pilot programs to full-scale deployment. Analysts highlight this as a critical step toward establishing a tokenized economy anchored by XRP's utility.

XRP Utility Debate Erupts as Ripple CTO Addresses Adoption Concerns

The utility of XRP faces renewed scrutiny after a viral social media debate between crypto influencer Andrei Jikh and Ripple's Chief Technology Officer David Schwartz. With over 2.5 million subscribers, Jikh challenged XRP's role as a bridge currency in an era dominated by stablecoins and central bank digital currencies.

Schwartz acknowledged sluggish on-chain adoption, citing regulatory hurdles that even prevent Ripple from using XRP Ledger's decentralized exchange for payments. The CTO defended XRP's volatility by emphasizing its transaction speed as a risk mitigant, comparing its utility to traditional bridge currencies.

This public reckoning exposes the growing tension between XRP's original vision and its current adoption trajectory, despite Ripple's claims of 300+ banking partnerships. The discussion has reignited fundamental questions about the token's value proposition in an evolving digital asset landscape.

SEC's New Rules Pave Way for XRP ETF Approval as Early as September

The U.S. Securities and Exchange Commission has introduced streamlined listing standards that could accelerate approval for spot XRP exchange-traded funds. Analysts now identify a September-October 2025 window as plausible following the regulator's decision to accept six months of futures trading history as sufficient qualification—a significant reduction from the previous 240-day review process.

Coinbase's derivatives exchange emerges as a critical platform under the new framework, with its futures products serving as the benchmark for eligibility. The revised 75-day review window for rule changes further simplifies the path for crypto ETPs, including potential XRP funds.

Market participants highlight the SEC's recent endorsement of in-kind creation and redemption as equally consequential. This mechanism allows authorized participants to exchange actual cryptocurrency for ETF shares, potentially improving market efficiency and liquidity for any approved XRP products.

XRP Shows Bullish Signals as BlackRock Director Joins Ripple Swell 2025

XRP's technical indicators suggest a potential breakout as the cryptocurrency consolidates with surging volume. ChatGPT's analysis highlights a strong bullish structure, with XRP trading above all major EMAs. The RSI remains in neutral territory, indicating room for upward movement without overbought conditions.

BlackRock's Director of Digital Assets, Maxwell Stein, has announced participation in Ripple Swell 2025, fueling speculation of institutional adoption. The event could serve as a catalyst for XRP's price action, with technical patterns like a potential double bottom formation pointing to a breakout above $3.30.

Market participants are closely watching the MACD's critical zero line decision point, which could determine whether XRP continues its consolidation or enters an explosive breakout phase. The convergence of technical strength and institutional interest creates a compelling narrative for XRP's trajectory.

Ripple CTO Confirms XRP Remains Core to Payments Despite Stablecoin Push

Ripple's Chief Technology Officer David Schwartz has clarified that XRP continues to serve as the primary bridge asset in the company's cross-border payment solutions, despite increased marketing focus on its RLUSD stablecoin. The altcoin's utility in facilitating fast, low-cost international transfers remains unmatched, particularly in volatile market conditions where stablecoins face operational challenges.

Schwartz emphasized that XRP's role in Ripple Payments dwarfs all other digital assets in transaction volume. While RLUSD and other stablecoins excel in collateral-based use cases requiring price stability, XRP's liquidity and efficiency make it irreplaceable for Core settlement functions. The growing adoption of the XRP Ledger further strengthens the cryptocurrency's long-term value proposition.

Ripple vs. SEC Legal Battle Nears Conclusion with Potential August Appeal Dismissal

The protracted legal clash between Ripple and the U.S. Securities and Exchange Commission may reach a decisive inflection point by mid-August. Market observers anticipate a joint dismissal of appeals, which WOULD remove a critical overhang for XRP and its ecosystem.

Ripple CEO Brad Garlinghouse confirmed the withdrawal of the company's cross-appeal on institutional sales on June 27, 2025. The SEC is expected to follow suit, though formal court filings remain pending. A procedural deadline on August 15 looms as the next key milestone for case resolution.

Legal clarity could trigger a cascade of institutional moves, including suppressed announcements from Ripple's NDA-bound partners and potential ETF filings. "The market's been waiting for this resolution like traders waiting for a breakout," noted analyst Vincent Van Code, suggesting pent-up demand could materialize once regulatory uncertainty lifts.

Ripple CTO Addresses XRP Ledger's On-Chain Activity Gap Despite Bank Partnerships

Ripple's Chief Technology Officer David Schwartz has clarified the disconnect between the company's extensive bank partnerships and the limited on-chain activity on the XRP Ledger (XRPL). In a detailed response to investor Andrei Jikh's critique, Schwartz cited compliance hurdles, institutional behavior, and upcoming features like "permissioned domains" as primary reasons for the lag.

Despite Ripple's 300+ bank deals, XRPL has yet to see significant daily on-chain volume. Schwartz acknowledged the challenges faced by regulated entities in using public decentralized exchanges (DEXs) for payments, noting even Ripple cannot currently utilize XRPL's DEX due to counterparty risk concerns.

The discussion highlights broader questions about XRP's role as a bridge asset in a market dominated by stablecoins, as well as the ledger's competitiveness against private blockchain solutions favored by institutional players.

Ripple Price Forecast: XRP Shows Signs of Exhaustion Amid Tariff Uncertainty

Ripple (XRP) faces downward pressure as its recovery stalls below the $3.32 resistance level, trading at $3.09 on Thursday. The failed breakout reflects weakening retail demand and broader market volatility, exacerbated by the Federal Reserve's hawkish stance on interest rates.

Fed Chair Jerome Powell's ambiguous remarks during Wednesday's policy decision have left investors cautious. The central bank maintains a wait-and-see approach, with looming US tariff increases on Friday adding to the uncertainty. Countries without trade deals face reciprocal tariffs, though the WHITE House has secured only eight agreements so far—including a recent EU pact.

Technically, XRP leans bearish with a MACD sell signal and declining RSI. Market sentiment remains fragile as traders weigh the combined impact of monetary policy and trade tensions.

How High Will XRP Price Go?

Based on current technicals and news catalysts, XRP could see two potential scenarios:

| Scenario | Target | Timeframe | Key Triggers |

|---|---|---|---|

| Bullish | 3.60-4.20 | August-September | ETF approval, Ripple legal win |

| Bearish | 2.40-2.76 | Next 2 weeks | Market-wide correction |

Robert maintains: "The 3.19 resistance is critical - a weekly close above this would confirm our $5 year-end target."

html